Find out here which are the most popular candlestick formations and thus the ones most observed by traders. Candlestick patterns are easy to recognise and can play a decisive role in price forecasting.

More...

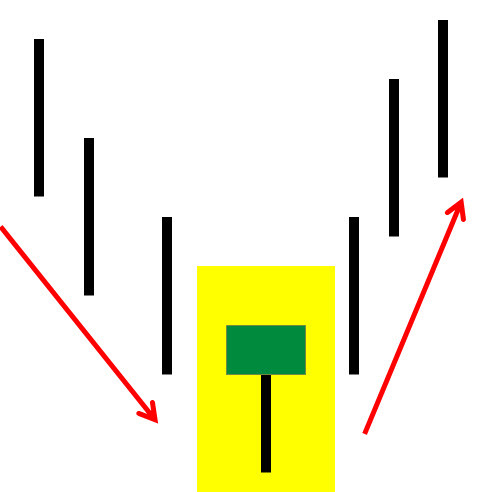

1st candlestick formation "Hammer"

The hammer is a "bullish" candlestick formation that indicates a change in direction and forecasts rising prices.

Requirements:

- The previous movement was downwards.

- The body of the candle is at the top of the candle (the colour of the candle is not important).

- The fuse (or lower shadow) should be at least twice the length of the body.

- There should be at most a very small wick (or upper shadow).

Possible trading approach

If the hammer is resolved upwards by the next candle, a long position is opened. As an aggressive trader, the SL (stop loss) is set directly under the hammer, otherwise using the chart technique. The trading volume and the TP (take profit) are determined via the distance to the SL on the basis of the earnings management.

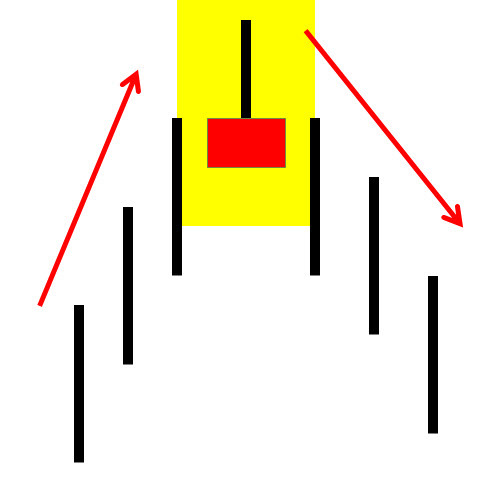

2nd candlestick formation "Shooting-Star"

The shooting star is a "bearish" candlestick formation that indicates a change in direction and forecasts falling prices.

CAUTION:

Not to be confused with the Inverted Hammer, often misread in the internet.

Requirements:

- The previous movement was upwards.

- The body of the candle is at the bottom of the candle (the colour of the candle is not important).

- The wick (or upper shadow) should be at least twice the length of the body.

- There should be at most a very small fuse (or lower shadow).

Possible trading approach

If the shooting star is resolved downwards by the next candle, a short position is opened. If you are an aggressive trader, you set the SL (stop loss) directly via the shooting star, otherwise using the chart technique. The trading volume and the TP (take profit) are determined via the distance to the SL on the basis of the earnings management.

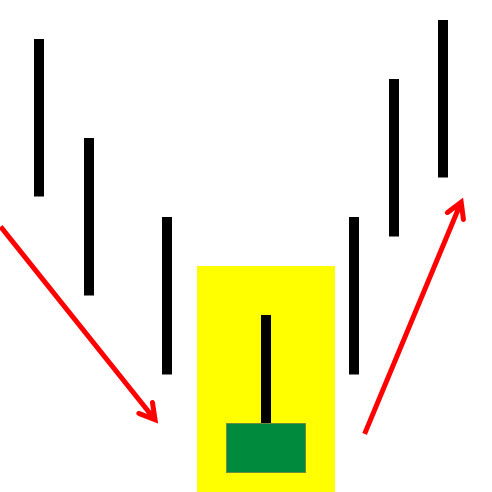

3rd candlestick formation "Inverted Hammer"

The inverted hammer is a "bullish" candlestick formation that indicates a change in direction and forecasts rising prices.

Requirements:

- The previous movement was downwards.

- The body of the candle is at the bottom of the candle (the colour of the candle is not important).

- The wick (or upper shadow) should be at least twice the length of the body.

- There should be at most a very small fuse (or lower shadow).

Possible trading approach

If the inverted hammer is resolved upwards by the next candle, a long position is opened. As an aggressive trader, the SL (stop loss) is set directly under the hammer, otherwise using the chart technique. The trading volume and the TP (take profit) are determined via the distance to the SL on the basis of the earnings management.

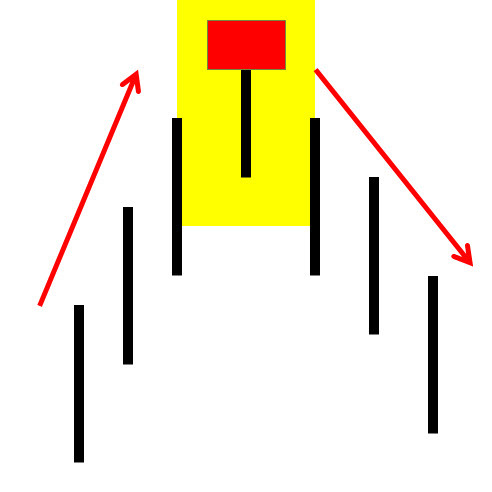

4th candlestick formation the "Hanging Man"

The Hanging Man is a "bearish" candlestick formation that indicates a change in direction and forecasts falling prices.

Requirements:

- The previous movement was upwards.

- The body of the candle is at the top of the candle (the colour of the candle is not important).

- The fuse (or lower shadow) should be at least twice the length of the body.

- There should be at most a very small wick (or upper shadow).

Possible trading approach

If the Hanging Man is resolved downwards by the next candle, a short position is opened. As an aggressive trader, the SL (stop loss) is set directly via the shooting star, otherwise using the chart technique. The trading volume and the TP (take profit) are determined via the distance to the SL on the basis of the earnings management.